At the time of writing, a £10 bet on the good people of the UK voting to leave the EU would yield a profit of £22.50, whereas the same bet on staying-in would return just £3.30. For those of you who don’t regularly have a flutter, that means the likelihood of Brexit is very slim. But then again that’s what the pollsters and bookies said about a Tory majority at the last election.

So if we believe the bookies, it seems the most likely impact of this referendum on the Didsbury property market will be fairly negligible. There could be some mild economic uncertainty followed by a return to business as usual following a vote to stay in. In fact, even this mild uncertainty will come to be seen as nothing compared with the rush to snap up buy-to-let properties before the April 2016 stamp duty hike and subsequent flood of properties onto the rental market.

But what would an ‘out’ vote mean for the 9,800 homeowners of Didsbury or even the landlords of the 7,308 private rented properties? Well we think it all comes down to how reliant each local market is on buyers who work in the financial services industry. Some commentators claim that in the event of Brexit, the large global banks could pull out of the UK and relocate to somewhere within the EU, most likely Frankfurt. That would result in an exodus of relatively high income workers from the market, and it is these people who have been instrumental in putting upward pressure on house prices since the 1980’s.As we all know, people working in financial services are mainly concentrated in South East England, within commuting distance to the City of London and Canary Wharf. However, there are also provincial outposts in the north of England, particularly in Leeds.

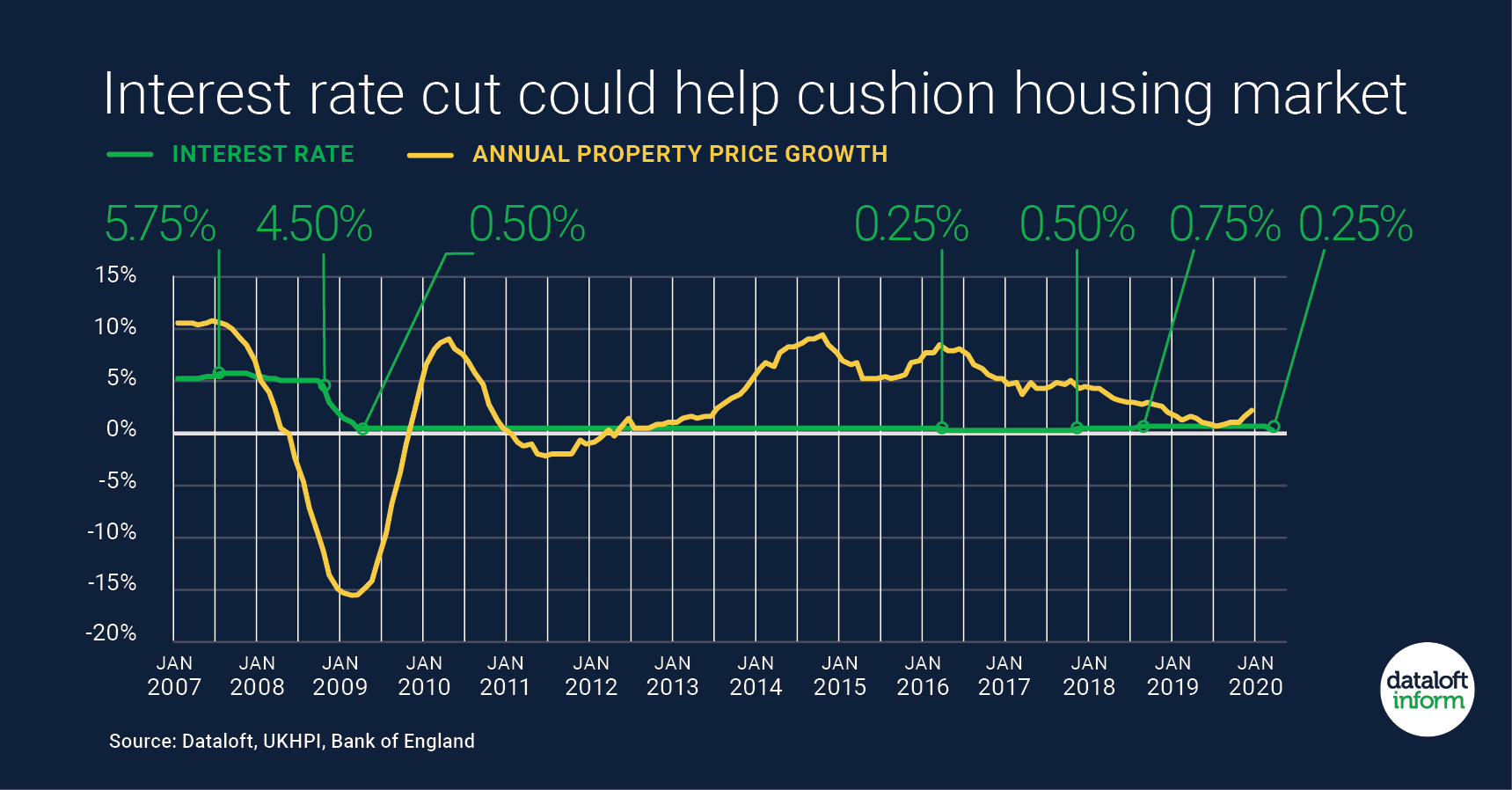

In Didsbury, there are 1,247 people working in financial services, equal to 4.7% of all jobs. In the context of the national picture, that puts it in the top half of all areas in terms of the concentration of financial services jobs. So the bottom line is that in relative terms, Didsbury is fairly reliant on the financial services industry. Consequently, Didsbury’s property market would be moderately exposed in the event of Brexit.However, there is a broader economic consequence of Brexit which would pose a menace to the M20 and UK housing markets – interest rate rises.

Theoretically, this could see the cost of mortgages grow swiftly, pricing many out of the market and generally making life difficult for buyers. However most buyers take fixed rate mortgages and two-thirds of landlords buy without a mortgage, so this would dampen the effects in the short-term. It’s also conceivable that inflation would ramp up substantially if the price of imports went up, and if the Bank of England responded by increasing interest rates we might get into the situation we were in in the late 1980’s when mortgages were sky high, but inflation was eroding the debt.

So in reality, if we really knew what was going to happen, we wouldn’t be agents in Didsbury, but City wizz kids earning billions. But what we can say is that you should make your own decision on the 23rd of June 2016 safe in knowledge that whatever the result, there will always be threats but also opportunities that the savvy homebuyer can take advantage of.

The key thing is for those selling and renting to be realistic in their pricing to reflect the current mood and tone of the market.

As you can tell, we’ve tried to remain fairly balanced and neutral for the purposes of this article, but feel free to pop into the branch to hear what the team really think!