The British press is being so hysterical about the UK property market at the moment, you’d be forgiven for thinking we were back in 2008 again, staring down the barrel of another credit crunch. This couldn’t be further from the truth. Week after week, more statistics come out revealing how buoyant the market is at the moment. Here are just three of the reasons why homeowners in Didsbury should be grinning.

The first and main reason to be happy is illustrated very clearly in the chart above. Long term house price growth in the area has been strong, with the average annual rate of growth since 2000 sitting at an admirable 10.9 per cent. The broad base of the market and the solid fundamentals underpinning it mean we expect this to continue in the medium and long term.

The next reason to be happy is the abundance of liquidity in the market. In laymen’s terms, this means that lots of people are buying and selling and the market isn’t in danger of stagnation. As of the fourth quarter of 2017, the data shows that sales now sit at their long-run equilibrium level, that is to say below the 2007 peak but above the trough of the credit crunch.

Rental returns: Despite former Chancellor George Osborne’s best attempts to slow down the buy-to-let market, the demand for rental property looks like it will increase. There will be plenty of chances for canny landlords thinking about purchasing a buy-to-let property or expanding their portfolio. The current local median monthly rent is £1,030, which means you could enjoy yields of 5 per cent.

With demand for homes increasing, vendors are in a healthy position where they can realistically hope to achieve the asking price, or higher, for their property. When you compare lack of availability to high demand, it seems even more plausible that you will be happy with the final sale price.

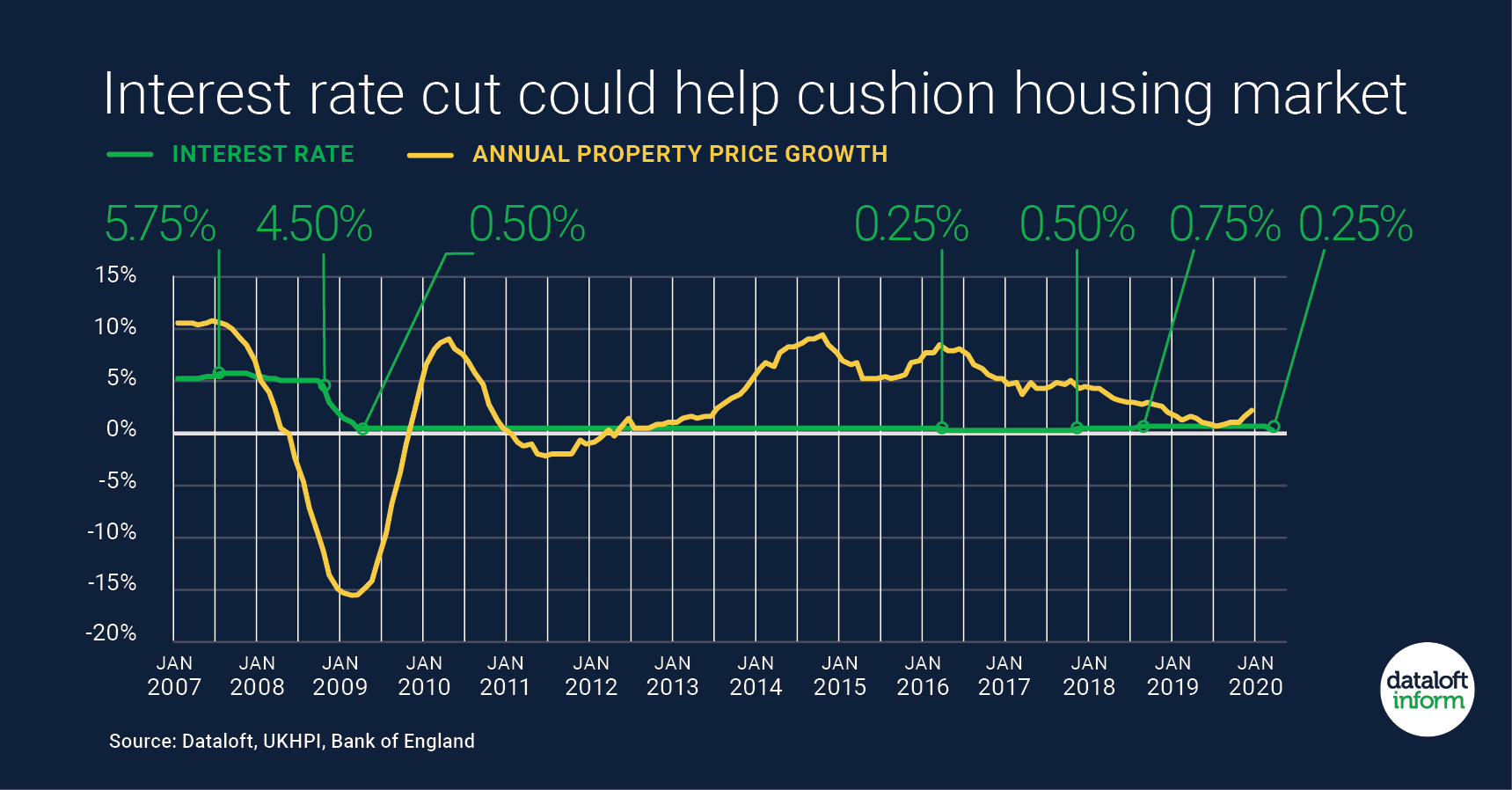

The third reason to be happy is the amount of sanity in the market which has come about due to more grown-up mortgage regulation. The meteoric rise in prices in the area pre-2008 led to price ‘froth’ building up in the market which ultimately caused the 2008 crash. While price growth since 2008 has been less rapid, it is far more sustainable and will save us from another crash. Why don’t you pop into our office for the full low-down?