Skip to content

MORTGAGE DEBT: A REGIONAL BREAKDOWN

- £873 billion – the total value of mortgage debt across England, according to the latest data released by UK Finance. That equates to just over £130,000 for every owner occupier mortgaged household across England.

- The level of mortgage debt is rising, up 2% on a year ago, and 8% higher than four years ago. That’s not surprising given stretched affordability and the increasing number of longer-term mortgages. Over half of all first-time buyer mortgages are issued for a period of 30 years or more according to the 2017/18 English Housing Survey, up from just 40% in 2015/16.

- The level of debt per household is highest across the capital, where property prices are close to twice the England average. Less than half of all households across London are owner-occupiers, just 22% of households are owner-occupiers with a mortgage. This compares to 65% and 30% respectively across the rest of England.

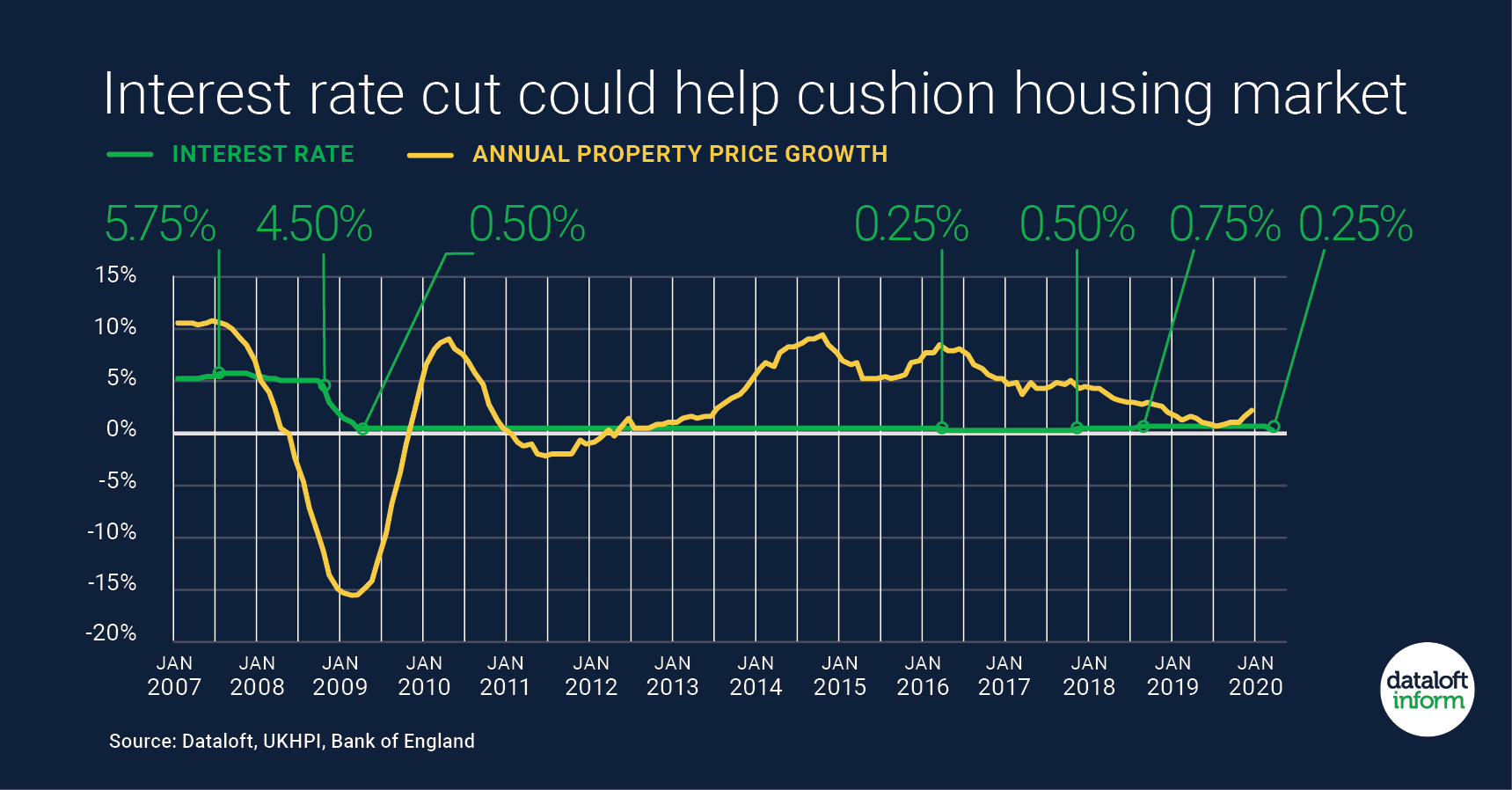

- To date in 2018, 95% of all new mortgages issued for new homes and remortgages have been on fixed-rate deals. While the average interest rate has increased slightly, from 2.09% in January to 2.2% in May, this remains low compared to historic standards and any interest rate rise is unlikely to cause significant waves across the market.

Share This Story, Choose Your Platform!