As I’m sure you’ve noticed, things have changed a lot for first-time buyers recently. Government schemes and mortgage requirements seem to change every week, so would-be homeowners have got to keep up. However, for those in the know, there are a lot more options in Didsbury than there used to be.

The first challenge awaiting would-be home-owners these days is the deposit for the mortgage. The bigger the deposit, the better the chances of getting a great deal. The minimum required deposit is around 5%, so with an average home in Didsbury valued at £272,600 locals will require a deposit of at least £13,600. That’s quite a lot of saving up, given that average annual salaries in the region are £25,700.

The Government has stepped-up to help make saving easier. The newly introduced ‘Help To Buy ISA’ will hopefully make saving for a first home quicker and less painful. Save £200 and the Government will contribute £50 each time.

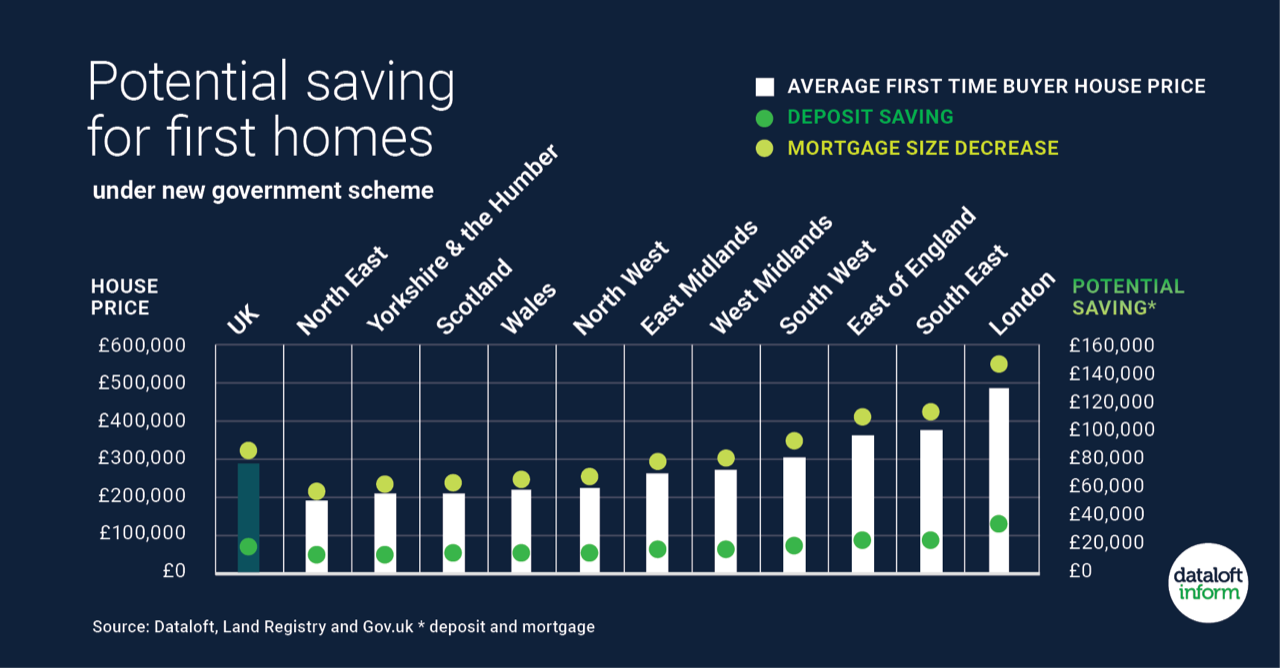

The Government has also made it easier for first-time buyers to purchase new-build properties. With the ‘Help To Buy’ scheme, they still need a deposit of around 5%, but then the Government loan a further 20% interest free for the first five years, meaning they only need a mortgage for 75% of the property price. In London the loan is up to 40%. After year five they have to pay interest at 1.75% of the shared equity loan at the time they purchased the property, rising each year after that by the Retail Prices Index (RPI) plus 1%. Sell up or pay the mortgage back and they’ll be asked to repay the Government’s share of the loan, along with a share of any increase in the home’s value.

Interestingly, of the 146,500 people who took advantage of the ‘Help To Buy’ scheme between the 1st of April 2013 and the 31st of December 2015, only 14 of them were in Didsbury. Low figures are usually down to either low house building rates or local prices being above the £600k ceiling for ‘Help To Buy’.

Another option for buying a first home in Didsbury is shared ownership, which allows a would-be homeowner to part-buy part-rent their property. Back in 2011, there were 95 shared ownership properties in Didsbury and given the national growth rate there should be around 112 now.

Under this scheme, owners start off with buying anything from 25% to 75% of their home, usually with a mortgage, and paying a monthly rent to a housing association, who will usually give the occupier the chance to increase their ownership share, known as ‘staircasing’.

Shared ownership isn’t available to everyone though. Applicants must earn less than £60,000 per year (with some flexibility for London buyers) and be a first-time buyer.

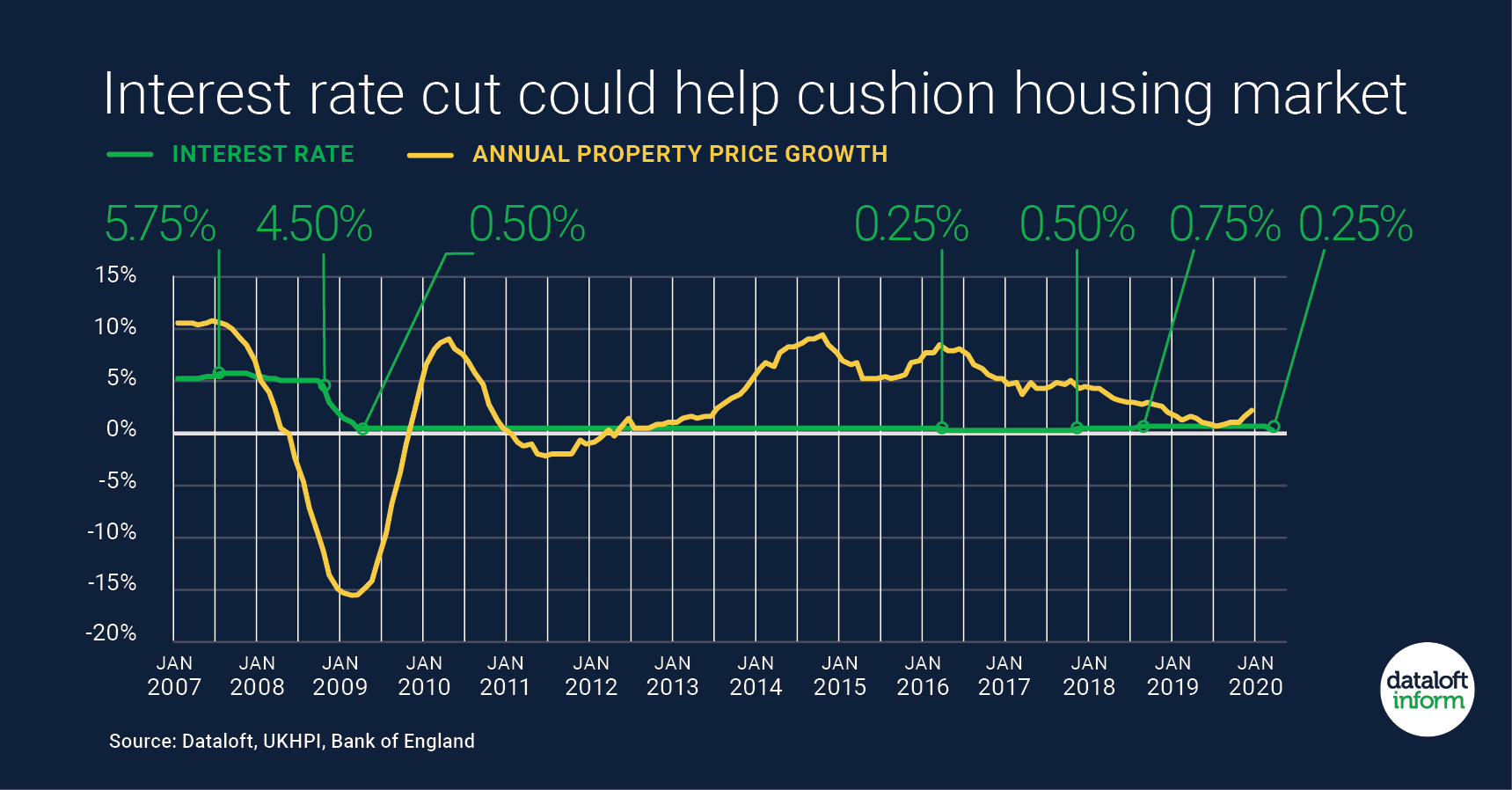

Once that’s all sorted out, the first-time buyer will need to look at how much their monthly repayments will be, and whether they’re affordable. It’s likely that six months of bank statements will be required to check on financial behaviour and spending patterns. Any regular payments, such as loan repayments, utility bills, childcare or travel costs will also be looked at. After the credit crunch made the banking world considerably more cautious, a lender will also carry out a ‘stress test’, where they check to see if the borrower could still afford the mortgage if they were to lose their job, have children or their personal circumstances changed.

If you or your children want to get the keys to a first home please pop into the branch or give us a call.