At £8.32 billion, Treasury coffers netted £750 million less in residential SDLT (Stamp Duty Land Tax) receipts across England in the financial year to the end of April, compared to 2017/18. This is despite just 16,000 fewer transactions taking place.

All regions witnessed a fall in receipts except for the East and West Midlands. The London market accounts for over half the fall, with receipts down by more than 10% over the year, the equivalent to £380 million.

45% of SDLT income in England and 38% of LTT income across Wales, is attributable to properties that were subject to the Higher Rate of Additional Dwellings tax, the 3% element accounting for a fifth of total receipts collected.

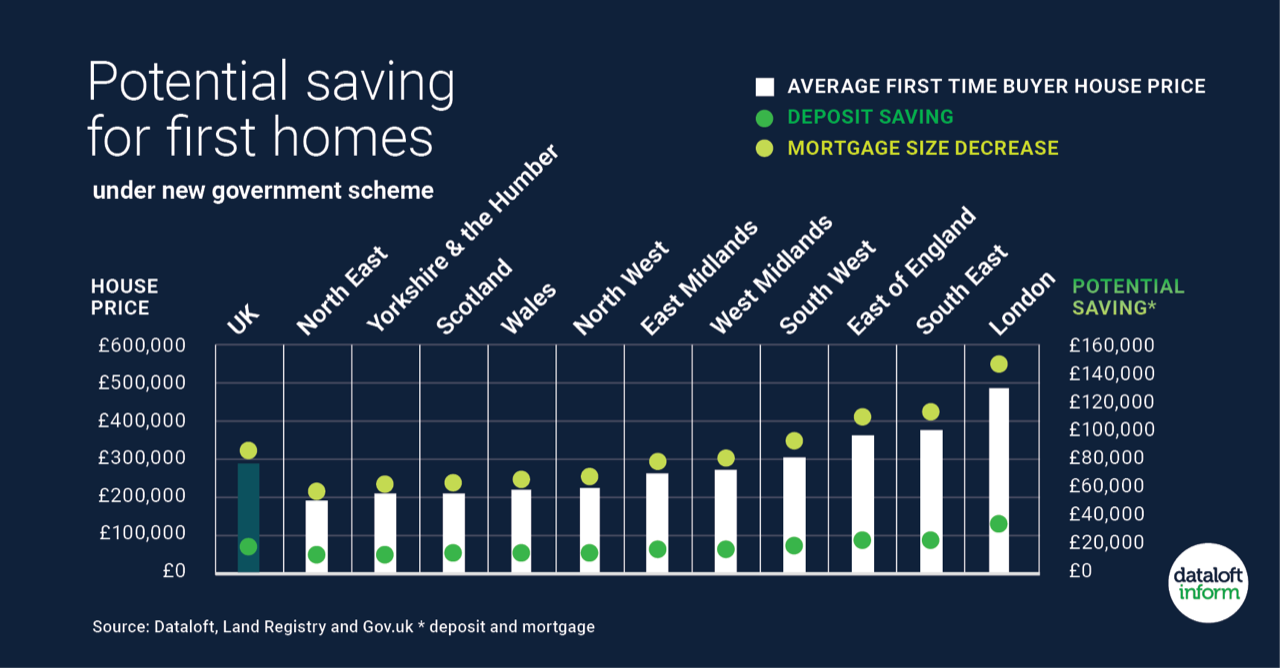

Across England close to 214,000 first-time buyers benefited from Stamp Duty Relief, a loss to the Treasury of over half a billion.