Skip to content

JUST 35% OF THOSE AGED 25–34 OWN THEIR OWN HOME

- Just 35% of 25 to 34 year olds were homeowners in 2017, down from 55% twenty years ago. Only 60% of young adults with a 10% deposit and a loan based on an income multiplier of 4.5, can afford the cheapest properties in their local area according to a new report produced by the Institute of Fiscal Studies.

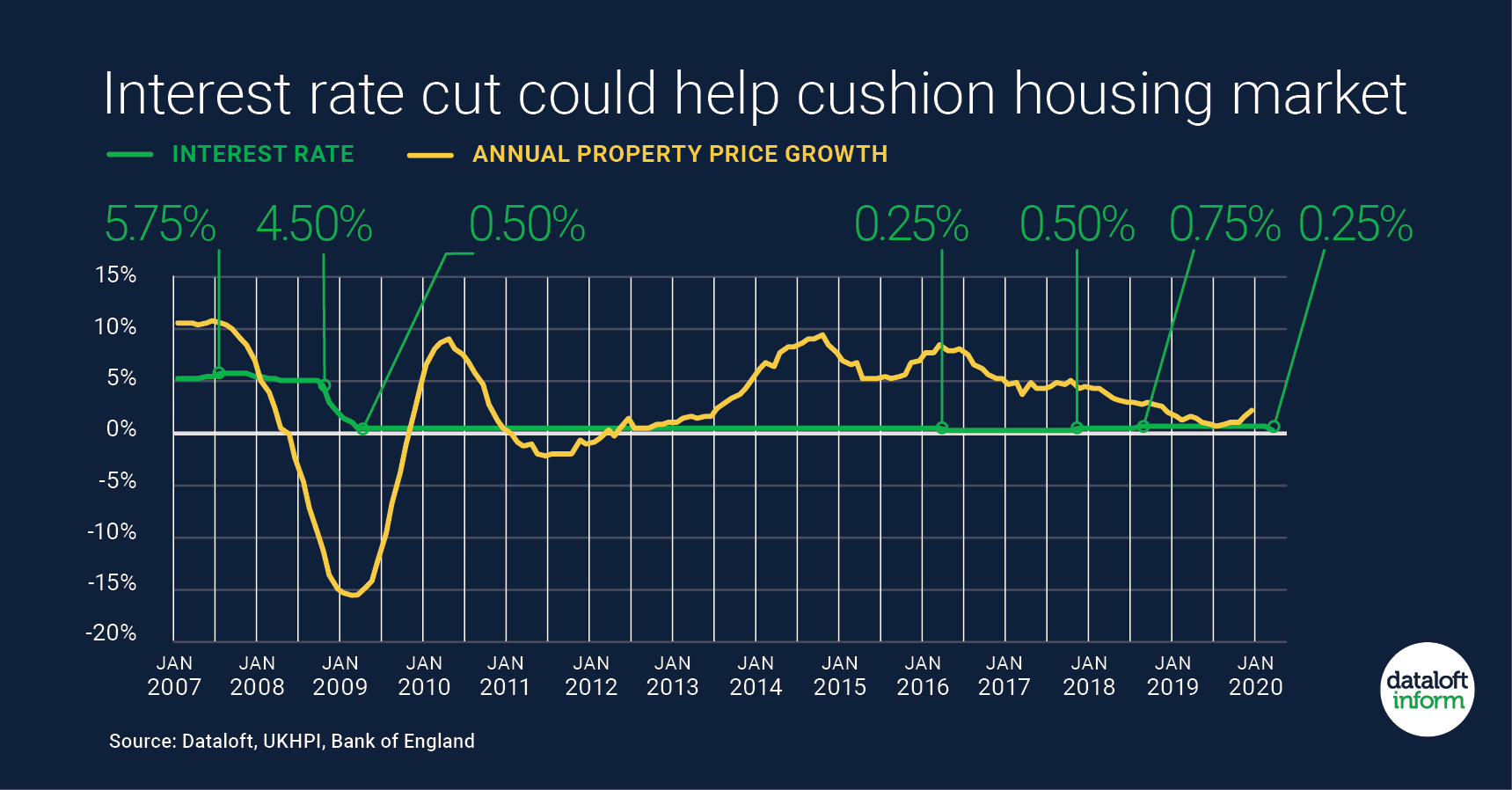

- Rising property prices, primarily prior to the financial crisis, compared to incomes have been the major factor in this change. Adjusting for inflation, average house prices in England have risen by 173% over the last twenty years, compared to real incomes of those aged 25 to 34 which have risen by just 19%.

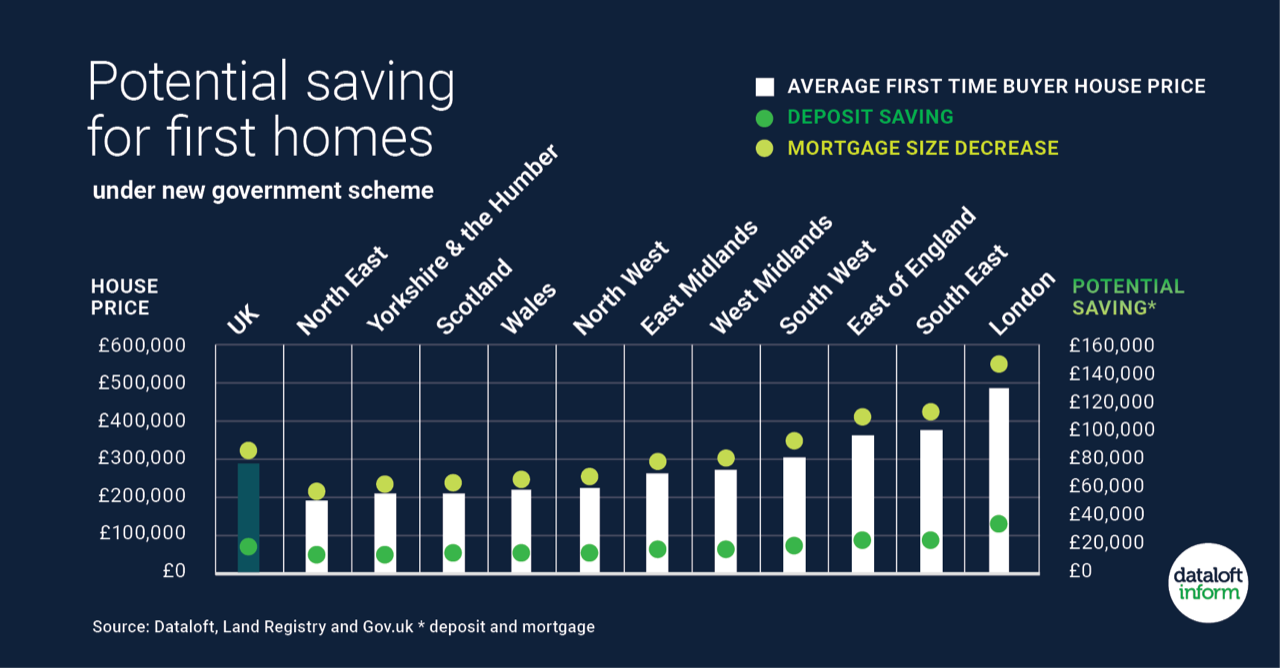

- Regional disparity in house prices is far more acute than among incomes. Across London and the South East over 90% of young adults would need to save at least six months’ income for a 10% deposit on an average priced home in their area. This compares to under 60% across the North East, North West and Yorkshire and the Humber.

- The introduction of incentives such as Help to Buy, have undoubtedly proved beneficial for many first-time buyers. Nearly 170,000 have benefitted from a Help to Buy equity loan since its introduction in 2013. Similarly, over 69,000 first-time buyer households have saved on average £2,300 each thanks to the first-time buyer stamp duty tax relief announced in the 2017 Budget.

Share This Story, Choose Your Platform!